Challenges and opportunities of the logistics automation industry under the global situation in the first half of 2025

Release Time : 2025-06-17

I. Macro background: the political and economic situation is turbulent, and the global supply chain is reshaped at an accelerated pace

In the first half of 2025, the global political and economic situation continues to escalate, directly affecting the rhythm of cross-border manufacturing, export trade and logistics infrastructure investment. Especially for the logistics automation industry, multiple uncertainties from geopolitics, trade policies, financial markets and energy prices have formed a complex situation where "black swans" and "gray rhinos" coexist.

Sino-US relations have become tense again. In February 2025, the US government added tariffs on automation equipment, industrial sheet metal products, low-voltage controllers and other items exported to China, with a tax rate between 25% and 35%. This not only directly increases the export costs of Chinese automation equipment manufacturers, but also exacerbates the uncertainty of order transfer.

The EU has strengthened the review mechanism for technical products in China, especially those involving intelligent warehousing system control technology and data acquisition modules, and the customs clearance cycle has been significantly extended. Some Chinese equipment export companies have reported that the customs review period is as long as 25 to 40 days, which seriously affects delivery commitments and project advancement.

Global raw material prices continue to rise. According to LME data, the average global steel price rose by 12.4% year-on-year in the first half of 2025, and the aluminum price rose by 9.6%. The cost of raw materials such as cold-rolled steel, profiles, and spray coatings that logistics equipment sheet metal processing relies on has increased significantly, resulting in a general compression of corporate manufacturing profits.

With the tightening of the capital market and high interest rates, overseas customers are more cautious in project establishment and equipment investment. The pace of implementation of large e-commerce warehousing projects in North America and Europe has slowed significantly, and some logistics parks planned to be built in 2025 have announced delays in implementation or phased advancement.

Under this environment, although the global logistics automation industry maintains a medium-to-high-speed growth trend, the coexistence of "market opportunities" and "operational risks" is more obvious.

II. Industry status: The global market is uneven, and demand transformation drives structural optimization

Against the background of the above external pressures, the logistics automation industry has not fallen into a downturn, but has shown the typical characteristics of regional differentiation + structural upgrading + customer refinement. Several international research institutions have unanimously predicted that the global logistics automation market will reach US$93.2 billion in 2025, a year-on-year increase of about 10.7%, with Asia Pacific (especially Southeast Asia) and North America as the strongest growth engines.

1. Increased demand for system integration and overall solutions

More and more customers tend to shift from purchasing single equipment to choosing logistics automation engineering solutions that include planning and design, equipment manufacturing, installation and commissioning, and after-sales operation and maintenance. For example, cold chain distribution centers in the United States, e-commerce centers in Vietnam, and new industrial park projects in Indonesia have all begun to require integrators to provide "turnkey" service capabilities.

2. Intelligent upgrade of conveying and sorting systems

Conveying system solutions are accelerating from traditional fixed beat systems to intelligent systems with flexible path planning, intelligent identification and multi-segment conveying capabilities. Roller conveyors are equipped with intelligent motor drive modules, which can achieve energy-saving control and remote monitoring, and gradually replace old equipment; belt conveyors continue to improve in speed, stability and ability to adapt to temperature and humidity environments to meet the personalized needs of the pharmaceutical, e-commerce, and 3C industries.

In terms of sorting system solutions, multi-layer cross-belt, flap-type, and slider-type sorting technologies continue to evolve, and after integrating AI algorithms, higher sorting accuracy and processing efficiency are achieved. Especially in the fields of express delivery, aviation, and high-end manufacturing, the demand for order accuracy and response speed has increased significantly, pushing sorting automation from "optional" to "standard".

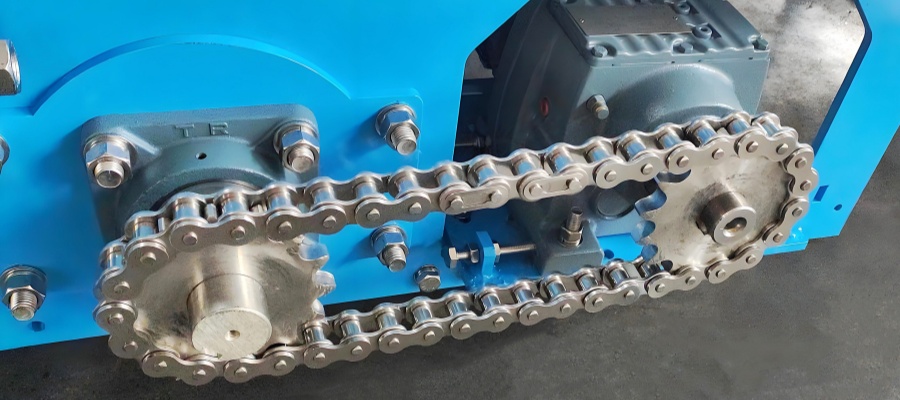

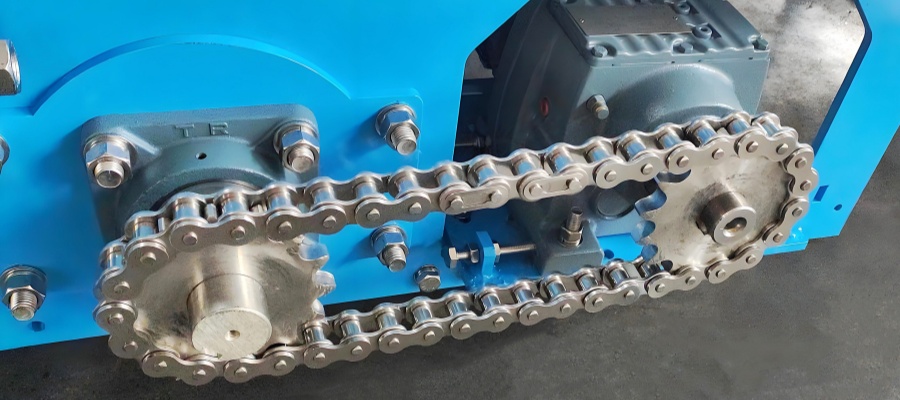

3. Sheet metal manufacturing capabilities have become the core competitiveness of equipment

The compactness, durability, and aesthetics of equipment structures are increasingly dependent on high-precision sheet metal processing and assembly processes. From chassis frames, surrounding shells to supporting slides, logistics equipment sheet metal processing manufacturers need to have integrated capabilities from laser cutting, automatic bending, welding and grinding to surface treatment to ensure the operational reliability of automation equipment in high-intensity continuous operation scenarios.

III. Industry challenges: operational and strategic dilemmas under multi-dimensional pressure

1. Global tariff barriers are upgraded, and the profitability of export companies is compressed

After the Sino-US trade relations became tense again in 2025, the United States imposed high tariffs on some Chinese automation equipment and components, including various types of belt conveyors, roller conveyors, PLC control systems, etc. The price of equipment exported to the United States was passively raised by 15%-20%, causing customers to turn to third-country products such as Mexico, Poland, and Turkey for alternatives.

A Jiangsu equipment manufacturer reported that the total export order volume in the first quarter decreased by 28% year-on-year, of which the orders from US customers decreased by more than 40%. Under the pressure of high tariffs, high freight rates, and low profits, companies have to reduce gross profit to maintain cooperative relationships, which seriously affects cash flow and reinvestment capabilities.

2. Raw material prices and manufacturing energy consumption both rise, and cost structure is restructured

In the first half of 2025, industrial electricity prices rose by 8%, natural gas prices fluctuated frequently, and environmental protection supervision became stricter, and the costs of high-energy consumption links such as sheet metal spraying and laser welding increased significantly. Traditional manufacturing processes have been difficult to adapt to the market demand for fast delivery and flexible customization.

At the same time, the unstable delivery of raw materials also seriously affected the delivery cycle of the whole machine. For example, the average cycle from ordering to arrival of aluminum profiles has been extended to 18-21 days, and the assembly period of logistics equipment has been forced to be extended by more than one week, and project delays have increased.

3. Cross-border projects are more difficult to implement

For logistics automation projects that are mainly "turnkey", geopolitical risks, on-site language and cultural barriers, personnel visas and compliance complexities have generally lengthened the project promotion cycle. Although Vietnam, Indonesia and other countries have huge market potential, there are great challenges in project communication, engineering construction, and safety standards. In addition, local power facilities and foundation conditions are unstable, which puts higher requirements on equipment design and installation technology.

IV. Development opportunities: Regional dividends and technology upgrades have brought about a strategic window period

1. Global warehouse automation investment remains strong

In the first quarter of 2025, Amazon, Target, FedEx and other companies in the United States invested a total of more than US$8 billion in automated warehousing equipment, with automatic conveying and intelligent sorting systems accounting for 63%;

The automation rate target of the new park of Prologis, a European logistics real estate developer, has been raised to more than 60%;

Due to rising labor costs, tight land use, and the prosperity of cross-border e-commerce, Southeast Asian countries are accelerating the construction of smart warehousing infrastructure.

2. The Belt and Road Initiative drives the export of local engineering services

Countries in the Middle East, Eastern Europe, Africa and other countries have begun to purchase "replicable" logistics automation solutions on a large scale in projects such as automated warehouses, conveyor lines, and express delivery centers by combining Chinese manufacturing with local engineering teams. Chinese automation equipment manufacturers and integrators export engineering capabilities through joint ventures, cooperation or subcontracting to reduce project management risks.

3. Service-oriented and digital capabilities bring new growth points

Data-driven intelligent logistics platforms have become a new trend in the industry. Extending from the equipment manufacturing end to system integration, remote monitoring, and predictive maintenance, it has become the strategic focus of leading companies. Customers are no longer only concerned about the price of equipment, but are more concerned about the comprehensive operating costs and failure rates during the use cycle.

V. Strategic recommendations: Building a closed-loop capability of "manufacturing + integration + service" is the key to breaking through

In order to break through multiple challenges and seize the initiative in the new round of global logistics intelligent upgrades, it is recommended that companies start from the following aspects:

Strengthen product modular design and cross-border adaptation capabilities

Unify interface standards to support different voltages, sensors, and protocol environments. Build a product strategy of "standard machine + customized module" to improve adaptability and delivery efficiency.

Expand overseas localized manufacturing and after-sales service system

Set up processing bases in Vietnam and Malaysia, build local after-sales engineering teams, improve response speed, and reduce transportation and tax costs.

Strengthen independent control and system integration capabilities

Expand self-developed PLC and WCS systems to improve core control capabilities; promote the upgrade from hardware manufacturing to a complete set of conveying system solutions and sorting system solutions to enhance customer stickiness.

Participate in global exhibitions and customer interaction scene construction

VI. Conclusion: Through turbulence, logistics automation moves towards the middle and high end of the global value chain

The global logistics automation industry is in a reshuffle period in 2025. Policy barriers, economic risks, and manufacturing costs are superimposed in multiple dimensions, but customers' long-term demand for intelligent warehousing, flexible transportation, and efficient sorting remains strong. For China's logistics automation integrators and automation equipment manufacturers, only by building a closed-loop service chain from high-end manufacturing, intelligent control to global engineering capabilities can they stand out in the new round of global supply chain competition and become an important driving force for industrial upgrading in the new era.

In the first half of 2025, the global political and economic situation continues to escalate, directly affecting the rhythm of cross-border manufacturing, export trade and logistics infrastructure investment. Especially for the logistics automation industry, multiple uncertainties from geopolitics, trade policies, financial markets and energy prices have formed a complex situation where "black swans" and "gray rhinos" coexist.

Sino-US relations have become tense again. In February 2025, the US government added tariffs on automation equipment, industrial sheet metal products, low-voltage controllers and other items exported to China, with a tax rate between 25% and 35%. This not only directly increases the export costs of Chinese automation equipment manufacturers, but also exacerbates the uncertainty of order transfer.

The EU has strengthened the review mechanism for technical products in China, especially those involving intelligent warehousing system control technology and data acquisition modules, and the customs clearance cycle has been significantly extended. Some Chinese equipment export companies have reported that the customs review period is as long as 25 to 40 days, which seriously affects delivery commitments and project advancement.

Global raw material prices continue to rise. According to LME data, the average global steel price rose by 12.4% year-on-year in the first half of 2025, and the aluminum price rose by 9.6%. The cost of raw materials such as cold-rolled steel, profiles, and spray coatings that logistics equipment sheet metal processing relies on has increased significantly, resulting in a general compression of corporate manufacturing profits.

With the tightening of the capital market and high interest rates, overseas customers are more cautious in project establishment and equipment investment. The pace of implementation of large e-commerce warehousing projects in North America and Europe has slowed significantly, and some logistics parks planned to be built in 2025 have announced delays in implementation or phased advancement.

Under this environment, although the global logistics automation industry maintains a medium-to-high-speed growth trend, the coexistence of "market opportunities" and "operational risks" is more obvious.

II. Industry status: The global market is uneven, and demand transformation drives structural optimization

Against the background of the above external pressures, the logistics automation industry has not fallen into a downturn, but has shown the typical characteristics of regional differentiation + structural upgrading + customer refinement. Several international research institutions have unanimously predicted that the global logistics automation market will reach US$93.2 billion in 2025, a year-on-year increase of about 10.7%, with Asia Pacific (especially Southeast Asia) and North America as the strongest growth engines.

1. Increased demand for system integration and overall solutions

More and more customers tend to shift from purchasing single equipment to choosing logistics automation engineering solutions that include planning and design, equipment manufacturing, installation and commissioning, and after-sales operation and maintenance. For example, cold chain distribution centers in the United States, e-commerce centers in Vietnam, and new industrial park projects in Indonesia have all begun to require integrators to provide "turnkey" service capabilities.

2. Intelligent upgrade of conveying and sorting systems

Conveying system solutions are accelerating from traditional fixed beat systems to intelligent systems with flexible path planning, intelligent identification and multi-segment conveying capabilities. Roller conveyors are equipped with intelligent motor drive modules, which can achieve energy-saving control and remote monitoring, and gradually replace old equipment; belt conveyors continue to improve in speed, stability and ability to adapt to temperature and humidity environments to meet the personalized needs of the pharmaceutical, e-commerce, and 3C industries.

In terms of sorting system solutions, multi-layer cross-belt, flap-type, and slider-type sorting technologies continue to evolve, and after integrating AI algorithms, higher sorting accuracy and processing efficiency are achieved. Especially in the fields of express delivery, aviation, and high-end manufacturing, the demand for order accuracy and response speed has increased significantly, pushing sorting automation from "optional" to "standard".

3. Sheet metal manufacturing capabilities have become the core competitiveness of equipment

The compactness, durability, and aesthetics of equipment structures are increasingly dependent on high-precision sheet metal processing and assembly processes. From chassis frames, surrounding shells to supporting slides, logistics equipment sheet metal processing manufacturers need to have integrated capabilities from laser cutting, automatic bending, welding and grinding to surface treatment to ensure the operational reliability of automation equipment in high-intensity continuous operation scenarios.

III. Industry challenges: operational and strategic dilemmas under multi-dimensional pressure

1. Global tariff barriers are upgraded, and the profitability of export companies is compressed

After the Sino-US trade relations became tense again in 2025, the United States imposed high tariffs on some Chinese automation equipment and components, including various types of belt conveyors, roller conveyors, PLC control systems, etc. The price of equipment exported to the United States was passively raised by 15%-20%, causing customers to turn to third-country products such as Mexico, Poland, and Turkey for alternatives.

A Jiangsu equipment manufacturer reported that the total export order volume in the first quarter decreased by 28% year-on-year, of which the orders from US customers decreased by more than 40%. Under the pressure of high tariffs, high freight rates, and low profits, companies have to reduce gross profit to maintain cooperative relationships, which seriously affects cash flow and reinvestment capabilities.

2. Raw material prices and manufacturing energy consumption both rise, and cost structure is restructured

In the first half of 2025, industrial electricity prices rose by 8%, natural gas prices fluctuated frequently, and environmental protection supervision became stricter, and the costs of high-energy consumption links such as sheet metal spraying and laser welding increased significantly. Traditional manufacturing processes have been difficult to adapt to the market demand for fast delivery and flexible customization.

At the same time, the unstable delivery of raw materials also seriously affected the delivery cycle of the whole machine. For example, the average cycle from ordering to arrival of aluminum profiles has been extended to 18-21 days, and the assembly period of logistics equipment has been forced to be extended by more than one week, and project delays have increased.

3. Cross-border projects are more difficult to implement

For logistics automation projects that are mainly "turnkey", geopolitical risks, on-site language and cultural barriers, personnel visas and compliance complexities have generally lengthened the project promotion cycle. Although Vietnam, Indonesia and other countries have huge market potential, there are great challenges in project communication, engineering construction, and safety standards. In addition, local power facilities and foundation conditions are unstable, which puts higher requirements on equipment design and installation technology.

IV. Development opportunities: Regional dividends and technology upgrades have brought about a strategic window period

1. Global warehouse automation investment remains strong

In the first quarter of 2025, Amazon, Target, FedEx and other companies in the United States invested a total of more than US$8 billion in automated warehousing equipment, with automatic conveying and intelligent sorting systems accounting for 63%;

The automation rate target of the new park of Prologis, a European logistics real estate developer, has been raised to more than 60%;

Due to rising labor costs, tight land use, and the prosperity of cross-border e-commerce, Southeast Asian countries are accelerating the construction of smart warehousing infrastructure.

2. The Belt and Road Initiative drives the export of local engineering services

Countries in the Middle East, Eastern Europe, Africa and other countries have begun to purchase "replicable" logistics automation solutions on a large scale in projects such as automated warehouses, conveyor lines, and express delivery centers by combining Chinese manufacturing with local engineering teams. Chinese automation equipment manufacturers and integrators export engineering capabilities through joint ventures, cooperation or subcontracting to reduce project management risks.

3. Service-oriented and digital capabilities bring new growth points

Data-driven intelligent logistics platforms have become a new trend in the industry. Extending from the equipment manufacturing end to system integration, remote monitoring, and predictive maintenance, it has become the strategic focus of leading companies. Customers are no longer only concerned about the price of equipment, but are more concerned about the comprehensive operating costs and failure rates during the use cycle.

V. Strategic recommendations: Building a closed-loop capability of "manufacturing + integration + service" is the key to breaking through

In order to break through multiple challenges and seize the initiative in the new round of global logistics intelligent upgrades, it is recommended that companies start from the following aspects:

Strengthen product modular design and cross-border adaptation capabilities

Unify interface standards to support different voltages, sensors, and protocol environments. Build a product strategy of "standard machine + customized module" to improve adaptability and delivery efficiency.

Expand overseas localized manufacturing and after-sales service system

Set up processing bases in Vietnam and Malaysia, build local after-sales engineering teams, improve response speed, and reduce transportation and tax costs.

Strengthen independent control and system integration capabilities

Expand self-developed PLC and WCS systems to improve core control capabilities; promote the upgrade from hardware manufacturing to a complete set of conveying system solutions and sorting system solutions to enhance customer stickiness.

Participate in global exhibitions and customer interaction scene construction

Continue to participate in international exhibitions such as the Munich Transport and Logistics Exhibition in Germany, ProMat in Chicago, USA, and the Singapore Smart Logistics Expo, and display solutions and engineering capabilities in combination with local customer needs.

The global logistics automation industry is in a reshuffle period in 2025. Policy barriers, economic risks, and manufacturing costs are superimposed in multiple dimensions, but customers' long-term demand for intelligent warehousing, flexible transportation, and efficient sorting remains strong. For China's logistics automation integrators and automation equipment manufacturers, only by building a closed-loop service chain from high-end manufacturing, intelligent control to global engineering capabilities can they stand out in the new round of global supply chain competition and become an important driving force for industrial upgrading in the new era.